How to Calculate Opportunity Cost

Calculate the opportunity cost. The formula for total variable cost is.

For this scenario you would calculate the opportunity cost by taking the amount of the most lucrative option investing and subtracting the.

. Types of opportunity costs Explicit costs. Illustrating concept with production possibility frontiers. How to calculate opportunity cost.

Here are some examples. Opportunity Cost is the cost of the next best alternative forgiven. Youll need a handful of inputs to get started.

Related

So how to calculate labor cost percentage. War Economics by Arnold Kling. Explicit costs are the direct costs of an action business operating costs or expenses executed either through a cash transaction or a physical transfer of resources.

Weighted averages are often used in statistical research studies classrooms stock portfolios warehouse weight measurements and cost accounting. Labor costs include the cost of employee time to process invoices. If you have questions it is important to contact a tax advisor.

Therefore the cost of IT or rather of poor IT operation and management is 27504125 6876 per employee per year. In most cases this phrase refers to after-tax cost of debt but it also refers to a companys cost of debt before. Writing one report and forgoing 3 computer programs.

The qualifying closing costs are 10000 and a full bathroom remodel was 7000. Most of the time you calculate the cost basis for inherited stock by determining the fair market value of the stock on the date that the person in question died. This means explicit costs will always have a dollar value and involve a.

If our hypothetical restaurants revenue is lets say 80000 dollars in a year the Labor cost percentage is. This is double. Labor cost percentage Annual payroll labor cost Total revenue.

For a small 10 people company this will be 68760 per year. The opportunity cost is the difference between the most lucrative option and the chosen option. While opportunity cost is not an exact measure one way to quantify it is to estimate the potential future value that you opted not to receive and compare it with the value of the choice you made instead.

Easy to Use Cost Calculator. Cost of debt refers to the effective rate a company pays on its current debt. How not to calculate opportunity costdouble counting.

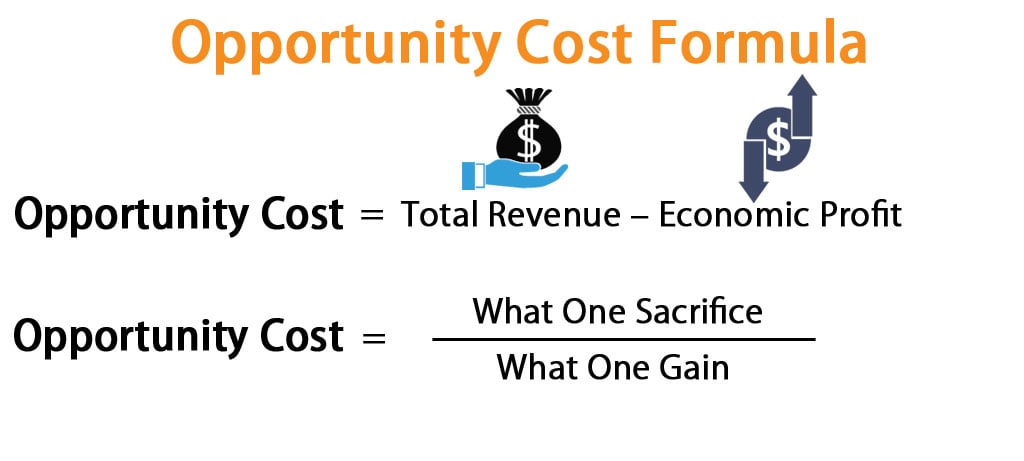

Heres a formula for calculating opportunity cost. Variable costs are entirely dependent on the organizations volume of production. Definition - Opportunity cost is the next best alternative foregone.

So get an idea of the cost of any language translation by using our tool. Using a conservative profit of 50 lets do some math again. If you dont know where your business falls on this range its time to gain some visibility by calculating the AP cost per invoice.

Just apply the following labor cost percentage formula to get the answer. We offer you an easy to use word count tool. They are the most time-consuming and complex costs to calculate so start there.

To calculate USPS shipping costs check out their price calculator. Examples of opportunity cost. Writing one report and forgoing 2 computer programs.

Jane Galt describes an article by Jamie Galbraith that among other things adds together the Budget cost of the war and the opportunity cost of doing something else such as expanding health care spending. How to Calculate Weighted Average To calculate the weighted average of a set of numbers you multiply each value by its weight and follow up by adding the products. Formula to Calculate Opportunity Cost.

So for 10 employees that will amount to 41250year in opportunity cost. The option the company chose however was to invest in new equipment for a return of 10000. Below we discuss what variable costs are why theyre important and how you can calculate them.

Calculate the opportunity cost for this scenario. In the above example the most lucrative option is investing in the securities which has a potential return of 12000. EconLog March 7 2003.

Because opportunity costs are not always easily definable or accounted for there is not always a simple solution to determine the opportunity cost for a particular situation. The calculation of a rental propertys cost basis is not an exact science and has many variables. The tool is free to use and it is quite easy as well follow the instructions on the page and you will get our quote.

Mailing your product or products that fits in a 12 x 12 x 5-12 box from Los Angeles to NYC using USPS Priority Mail 2-Day Large Flat Rate Box will cost you 2150 with a normal delivery time. However the following is a formula that some businesses use to calculate opportunity costs when possible. This would mean the cost basis for the property would be 217000.

Total Variable Cost Total Quantity of Output x Variable Cost Per Unit of Output. In just a few steps youll be able to find out your translation per word rate. An opportunity cost is broken down into several subcategories and there is a formula that economists use to determine the exact opportunity cost of making an investment or a financial decision.

The cookie is used to calculate visitor session campaign data and keep track of site usage for the sites analytics report. On March 30 2022. When a business must decide among alternate options they will choose the one that provides them the greatest return.

How To Calculate Opportunity Cost. The cookies store information anonymously and assign a. Cost Basis for Calculating.

In other words explicit opportunity costs are the out-of-pocket costs of a firm that are easily identifiable. Note that the acceptable labor cost percentages. Frankly speaking there is no such specifically agreed or defined on a mathematical formula for the calculation of.

Opportunity Cost Calculate Opportunity Cost Youtube

Calculating Opportunity Cost Youtube

Opportunity Cost Formula Calculator Excel Template

How To Calculate Opportunity Cost Youtube

0 Response to "How to Calculate Opportunity Cost"

Post a Comment